Yes. In our earlier discussion and in the following you haven't exhibited an understanding of the role that bitcoin performs, how and where that matters (economically and politically), you just browse the web and paste irrelevant things. That's not to be confused with knowledge.

Before law school I was a Finance and Economic double major and did my senior thesis on real time transfer systems before that was even really possible with the tech at the time.

Cut and pasting is awesome for writing papers, but it has to be used in a relevant way to demonstrate a grasp of the concepts in question.

So I understand just fine. 60,000 black marketers using worldwide it is cute. What's that, Crawfordville.

Statements like that are why I don't think you understand yet. I think you can, so I simply ask you to hear me out and I'll try to address some misconceptions in how you're approaching this.

Bitpay has 60,000 registered businesses at this time.

Are there 60,000 businesses registered in Crawfordville to make international monetary exchanges?

But I must stress, you're dismissive of the current size and ignoring the benefits of the medium, and where and why it has potential utility.

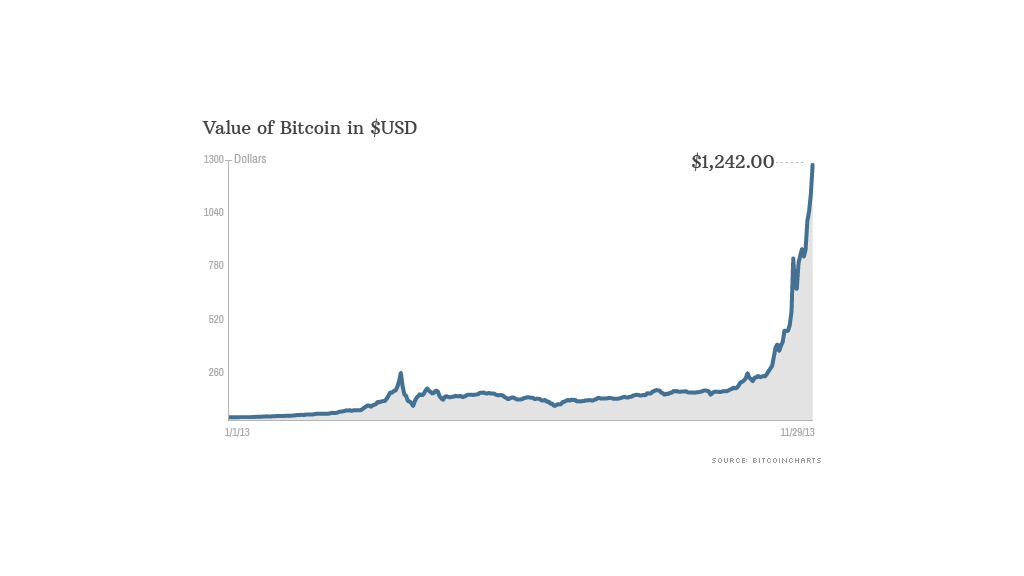

This is a little out of date as its about one year old, but the message is the same, very few people use it other than black marketers.

The problem with all that number crunching isn't the math itself, but the irrelevance of the conclusions. Wallets can be, for all intents and purposes, single use. You're not conveying anything remotely useful about the protocol by counting how many wallets have been used and then trying to average that amount in dollars at a single arbitrary exchange point.

I would fail you for providing me dribble like that as understanding of the advantages of the protocol.

To your effort to besmirch the exchange medium by unsavory association:

Is there a transaction medium that black marketeers prefer over US dollars? I understood the 500 Euro note was popular with organized crime, but I would have to think by any measure, the world over, black marketeers will trade for your drug crusted dollars before anything else.

Is that actually a negative if what you're talking about is a medium of exchange that people can use in spite of, and as protection from, government diktat and the power of legal tender laws under fiat money?

What more honorable signature can a reserve currency obtain than the faith of the black marketeers?

Me again. At the current rate of Bitcoin prices (down from then) that means the 1.2 million addressees had only $24 million, so they were "invested" at around $22 per person. I'm blown away.

Again, these aggregates you're making are not relevant to the protocol's utility. It's akin to multiplying last night's high temperature by last night's low temperature, dividing by the difference and telling me you understand meteorology. Stop it. It's embarrassing.

Even you started as less than a million cells. Does marking that point tell us something significant about where you're headed? That's what you're doing cut and pasting these things.

Think for a moment about the billions of people who live beyond this border, and the fact that billions of them already have mobile phones and over a billion of them already have smart phones.

When Jose wants to send money to Maria in Venezuela, or Honduras, or Cuba, consider his ability to do so and the cut Wells Fargo wants - if the governments in between will let him.

That business exists already today and it is bigger than Crawfordville. Payment processing is not a small time affair.

You should make an effort to understand what it is, how it actually works, and how a fixed medium of exchange with essentially no transaction cost over international distances offers advantages over fiat currencies that even the most cursory examinations of history will tell you get abused in a single direction.