Colleges

- AAC

- ACC

- Big 12

- Big East

- Big Ten

- Pac-12

- SEC

- Atlantic 10

- Conference USA

- Independents

- Junior College

- Mountain West

- Sun Belt

- MAC

- More

- Navy

- UAB

- Tulsa

- UTSA

- Charlotte

- Florida Atlantic

- Temple

- Rice

- East Carolina

- USF

- SMU

- North Texas

- Tulane

- Memphis

- Miami

- Louisville

- Virginia

- Syracuse

- Wake Forest

- Duke

- Boston College

- Virginia Tech

- Georgia Tech

- Pittsburgh

- North Carolina

- North Carolina State

- Clemson

- Florida State

- Cincinnati

- BYU

- Houston

- Iowa State

- Kansas State

- Kansas

- Texas

- Oklahoma State

- TCU

- Texas Tech

- Baylor

- Oklahoma

- UCF

- West Virginia

- Wisconsin

- Penn State

- Ohio State

- Purdue

- Minnesota

- Iowa

- Nebraska

- Illinois

- Indiana

- Rutgers

- Michigan State

- Maryland

- Michigan

- Northwestern

- Arizona State

- Oregon State

- UCLA

- Colorado

- Stanford

- Oregon

- Arizona

- California

- Washington

- USC

- Utah

- Washington State

- Texas A&M

- Auburn

- Mississippi State

- Kentucky

- South Carolina

- Arkansas

- Florida

- Missouri

- Ole Miss

- Alabama

- LSU

- Georgia

- Vanderbilt

- Tennessee

- Louisiana Tech

- New Mexico State

- Middle Tennessee

- Western Kentucky

- UTEP

- Florida International University

High School

- West

- Midwest

- Northeast

- Southeast

- Other

- Alaska

- Arizona

- California

- Colorado

- Nevada

- New Mexico

- Northern California

- Oregon

- Southern California Preps

- Washington

- Edgy Tim

- Indiana

- Kansas

- Nebraska

- Iowa

- Michigan

- Minnesota

- Missouri

- Oklahoma Varsity

- Texas Basketball

- Texas

- Wisconsin

- Delaware

- Maryland

- New Jersey Basketball

- New Jersey

- New York City Basketball

- Ohio

- Pennsylvania

- Greater Cincinnati

- Virginia

- West Virginia Preps

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How Much Has This "Market Correction" Cost You?

- Thread starter DFSNOLE

- Start date

Been an ugly little stretch. Winning the mega million drawing tonight would cover a decent chunk of what I've lost.

A lot, but I look at it like someone gave me an ice cream sundae and then took back a couple cherries.

There has been an incredible bull market the last 10 years. To paraphrase from another poster's recent post, make sure you have plenty of clean underwear, this is just a glimpse of the nasty bear that will cause enormous havoc. Strap in, because this roller coaster is about to dive. When the Fed raises rates the next time, it is going to accelerate the dive.

Yes, but we just need to know exactly when to get out. Don’t want to miss out on any of the upside.

Yes, but we just need to know exactly when to get out. Don’t want to miss out on any of the upside.

The answer is before October 9th, when @FreeFlyNole posted about parking some money in "safe" stocks for a little while. Freefly sparked the beginning of an enormous downturn.

Haven't even looked. I am in long term. In 2008 my 401k became a 201k. Now I am 5x that so thinking long term I will be fine.

Besides the Micron stock (ugh) I bought earlier this year that's dropped like a rock, not doing badly. Fortunately, I have Apple and Cyber Ark in my portfolio and they have held up well.

You have to think that the midterms will have an effect...

Don’t tell me what I have to do.

Not on the actions of the Fed.You have to think that the midterms will have an effect...

Little to nothing. After making my nut the past 2 years I stuck it all in a “safe” account and retired.

I got hit pretty hard. I'm still up, but there was a day when I looked at my stocks and thought I should sell now, and I didn't. It was that day that it hit it's peak.

i need to do a better job following my gut on these things. I could have sold, made a good mint, and then bought back a month later...but no....I didn't do that :/

i need to do a better job following my gut on these things. I could have sold, made a good mint, and then bought back a month later...but no....I didn't do that :/

Last edited:

I haven't looks at my statements all year. When I do get another job I will have to take a peek so I can rollover my current retirement savings but I don't plan on looking until then.

You can't time the market. Maybe in this instance you were right, but you will screw yourself long-term trying to do that.I got hit pretty hard. I'm still up, but there was a day when I looked at my stocks and thought I should sell now, and I didn't. It was that day that it hit it's peak.

i need to do a better job following my gut on these things. I could have sold, made a good mint, and then bought back a month later...but no....I didn't do that :/

I think we are around the same age. As a 40 year old, I buy automatic every month and only check my performance once a year to see if I want to adjust anything. It's easier on the nerves

Yeah I only check once or twice a year. I've got nothing fancy, mostly just a couple index funds. Wasted a few years trying to pick stocks or more shiny funds, learned my lesson on that. I haven't even looked at it since this, and won't any time soon.

I'm sure it's ugly, but what am I really going to do? Take it out of the wrong one and put it in the right one?

I'm sure it's ugly, but what am I really going to do? Take it out of the wrong one and put it in the right one?

I'm sure it's ugly, but what am I really going to do? Take it out of the wrong one and put it in the right one?

We’re talkin’ stocks, right?

The Dow fell another 613 points today which wiped out all the gains of 2018. Not sure that I want to look.

The Dow fell another 613 points today which wiped out all the gains of 2018. Not sure that I want to look.

Crap, and I didn't win the mega millions last night, either. This week sucks.

You mean since early May.The Dow fell another 613 points today which wiped out all the gains of 2018.

No.You mean since early May.

markets

Stock Rout Erases 2018 Gains for S&P, Dow Indexes: Markets Wrap

The sell-off in U.S. stocks accelerated, wiping out gains for the year in both the S&P 500 Index and the Dow Jones Industrial Average, as mixed corporate earnings and weak housing data fueled anxiety that rising prices will crimp economic growth. Treasuries rallied for a second day on demand for haven assets.

https://www.bloomberg.com/news/arti...-mixed-as-late-u-s-rally-falters-markets-wrap

Another article in case you didn't like the other.You mean since early May.

Dow erases gains for the year, tumbles more than 600 points as stocks extend October swoon

Dow falls 600 points 2 Hours Ago | 03:04

Stocks plummeted on Wednesday as a sharp drop in tech shares and worries about corporate earnings added fuel to this month's steep pullback.

The Dow Jones Industrial Average dropped 608.01 points at 24,583.42 and erased all of its gains for 2018. The S&P 500 dropped 3.1 percent to 2,656.10 and also turned negative for the year. The Nasdaq Composite fell 4.4 percent to 7,108.40— entering correction territory — as Facebook, Amazon, Netflix and Alphabet all traded lower.

https://www.cnbc.com/2018/10/24/dow...e-open-after-tuesdays-500-point-recovery.html

I only look at it a couple times a year as other mentioned. I figure what's the point.

I SHOULD have purchased some of the ARs last year and just sat on them. That and some gold and just wait to see if the depression hits within the next 2 years. Figure both of those have gone up no matter what.

I SHOULD have purchased some of the ARs last year and just sat on them. That and some gold and just wait to see if the depression hits within the next 2 years. Figure both of those have gone up no matter what.

October tends to be the "selloff" month regardless - AT&T is one blue chip that's an issue, but tech sector generally has been a bit problematic this year.

I spoke with my advisor yesterday and he says to stay steady in what I've got. At this point I'm in dividend stocks that are automatically reinvesting, but can change to monthly income when I need it.

I spoke with my advisor yesterday and he says to stay steady in what I've got. At this point I'm in dividend stocks that are automatically reinvesting, but can change to monthly income when I need it.

Yes, but we just need to know exactly when to get out. Don’t want to miss out on any of the upside.

Joe Kennedy Sr. said when he heard the guy that shined his shoes was entering into/in the market, he got out. Three months prior to Black Friday 1929. He knew when to get out....otherwise....we would've never heard of the Kennedy's....strange how life works.

going to take a gamble in my 401k with the drops that just happened. Then rebalance it once I am up about 15-20%, which I think will happen within the next 3 months.

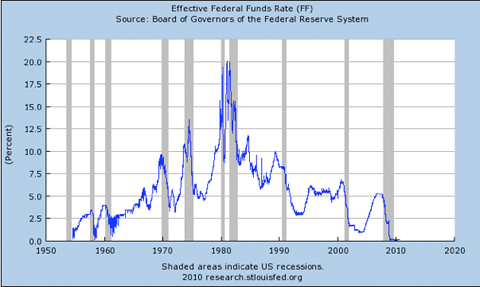

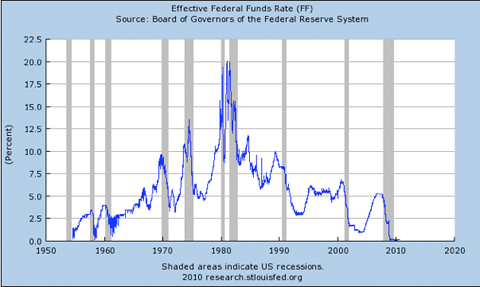

I just bought more Amazon . Thinking about buying even more. The market is in a correction all the fundamental are strong. Federal reserve is trying to bring interest rates back to normal after 10 years. Fed Chairman trying to get to 3-3.5 percent. Inflation is not an issue even with the tight employment numbers. It’s a buyers market.

Federal reserve is trying to bring interest rates back to normal after 10 years.

Which period of manipulation do you consider the normal?

I got hit pretty hard. I'm still up, but there was a day when I looked at my stocks and thought I should sell now, and I didn't. It was that day that it hit it's peak.

i need to do a better job following my gut on these things. I could have sold, made a good mint, and then bought back a month later...but no....I didn't do that :/

Does your gut tell you when to buy? For those are the opportunities most investors miss.

3-3.5 percent. It’s his stated goal. The chart you used show interest rates almost 0 for 8 years. I should have used the word neutral instead of the word normal.

Which period of manipulation do you consider the normal?

Last edited:

Because there was no blue wave. Tax cuts not in jeopardy.The market continues to like gridlock. Dems take the House. S&P up nearly 2%.

Similar threads

- Replies

- 0

- Views

- 146

- Replies

- 97

- Views

- 2K

- Replies

- 1

- Views

- 195

- Replies

- 10

- Views

- 397

- Replies

- 1

- Views

- 110

ADVERTISEMENT

Latest posts

-

-

Which FSU player is most likely to be drafted after Jared Verse?

- Latest: NoleLizards

-

-

ADVERTISEMENT